The recently released H1 2016 Market report by the independent global property consultancy Knight Frank details both the data gathered by the company from the real estate market’s activities during the first half of the year, in combination with an exciting preview of what is to come in the near future.

The recently released H1 2016 Market report by the independent global property consultancy Knight Frank details both the data gathered by the company from the real estate market’s activities during the first half of the year, in combination with an exciting preview of what is to come in the near future.

According to Ross Wheble, country manager of Knight Frank, the outstanding turnout of new construction projects has ultimately led to a stage of moderation as a means to address the short-term risks in the market. If all goes well after that, the report indicates that Cambodia has the potential to climb the ranks and outperform Southeast Asia through the process of diversification, a state in which “robust growth is expected to continue.”

Phnom Penh Office Sector:

Starting the year with the completion of three large office buildings that totaled to a net lettable space of 5,000 square meters, the second half of the year for the office sector may see a slight difference in trends as companies start to take interest in higher end commercial space and transfer to Grade A and Grade B office buildings. This is due to the difficulties of the Grade C units to keep up with changes in regulations and standards.

Starting the year with the completion of three large office buildings that totaled to a net lettable space of 5,000 square meters, the second half of the year for the office sector may see a slight difference in trends as companies start to take interest in higher end commercial space and transfer to Grade A and Grade B office buildings. This is due to the difficulties of the Grade C units to keep up with changes in regulations and standards.

The demand for higher grade buildings has also been apparent with several projects seeing higher amounts of inquiries, like in the case of the Vattanac Tower where the occupancy rate is now almost at 50%. This may be the reason why most of the supply coming in the next few years is Grade A buildings. These include the units that will come with the completion of projects like the Exchange Square, Diamond Twin Tower, and Olympia City.

The report by Knight Frank indicates that for the medium term, the country is expected to capture more foreign investments for the prime office space sector where prices may continue to rise from the current rate of $4,900 per square meter. This indicates bigger names moving in to do business in the country.

Retail Sector: If there is anything that the data from the retail market sector is indicating, it’s that there is growing interest from international brands to acquire retail space in the country. Although currently moving at a lower pace in terms of occupancy, the percentage remains constant for malls in strategic locations like the Aeon mall - which still enjoys their steady 95.8 percent occupancy rate. But this reprieve may not last long as newer retail space projects are expected to hit completion by 2020. The report indicates a projected total increase in retail area of around 209 per cent by that time.

If there is anything that the data from the retail market sector is indicating, it’s that there is growing interest from international brands to acquire retail space in the country. Although currently moving at a lower pace in terms of occupancy, the percentage remains constant for malls in strategic locations like the Aeon mall - which still enjoys their steady 95.8 percent occupancy rate. But this reprieve may not last long as newer retail space projects are expected to hit completion by 2020. The report indicates a projected total increase in retail area of around 209 per cent by that time.

But this may not necessarily be a bad thing, at least for businesses. Because along with the increase in the number of retail spaces available, rental prices will become even more competitive in contrast to the current range of $10 to $70 per square meter.

Hotel Sector:The hotel sector had its fair share of both troubles and successes during the first half of 2016. While boutique hotels garnered a significant amount of tourists, international five-star hotels like the Marriott struggled to increase their occupancy rate due to the competition with the local accommodations.

Despite this, another 175 keys will come into play with the completion of Rosewood Hotel, in addition to the 259 that was already added earlier this year.

But according to Knight Frank, the struggle of international hotel chains is going to end soon as more international hotel giants have expressed great interest in expanding their business into the Cambodian market. Should these plans push through, the estimated 2,732 rooms that are awaiting their completion by the end of the year may just be the start of the growth that is projected to happen by 2019.

But according to Knight Frank, the struggle of international hotel chains is going to end soon as more international hotel giants have expressed great interest in expanding their business into the Cambodian market. Should these plans push through, the estimated 2,732 rooms that are awaiting their completion by the end of the year may just be the start of the growth that is projected to happen by 2019.

This is also to address the anticipated influx of business tourists, especially by 2017 when the World Economic Forum will be held in the capital city, Phnom Penh.

Serviced Apartment Sector: Though most of the serviced apartments are locally owned, the market heavily relies on expatriates to rent and

occupy the properties. Currently at around 4,017 monitored units, there are around 1,730 more units that should be completed by 2018. This is expected to cause a significant decrease in rental price which currently ranges from $667 to $4,000 per month, depending if it’s in the high end market or not. The construction of more modern condominiums and small scale serviced apartments will also contribute to the decrease of the current value in the collection of serviced apartments.

Though most of the serviced apartments are locally owned, the market heavily relies on expatriates to rent and

occupy the properties. Currently at around 4,017 monitored units, there are around 1,730 more units that should be completed by 2018. This is expected to cause a significant decrease in rental price which currently ranges from $667 to $4,000 per month, depending if it’s in the high end market or not. The construction of more modern condominiums and small scale serviced apartments will also contribute to the decrease of the current value in the collection of serviced apartments.

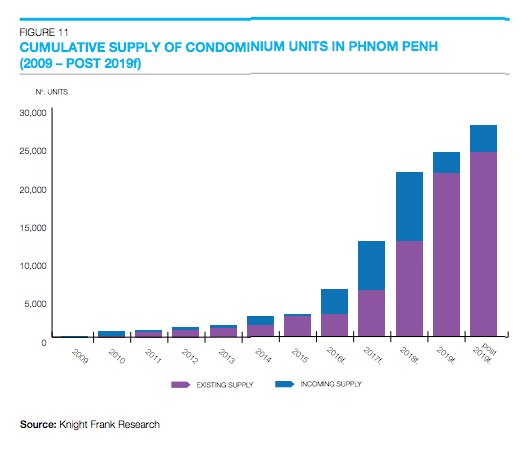

The condo market saw a 4.9 percent increase during the first few months this year. This comes up to a total of 2,797 units added in the supply which includes developments like The 240, Galaxy residences, and 9 East. 929 of these units were sold during the first half of 2016. This represents a decrease of about 26.7 percent since last year. these units were sold during the first half of 2016. This represents a decrease of about 26.7 percent since last year.

More and more projects of this type have been slated in the coming years, and 74 projects are noted to reach completion by 2020. 72 percent of these will be made up of high-end or prime condominium projects. For completed, central condominium rental rates, prices remain relatively high at a maximum of $4,000 per month. This is why it would be wise to disperse and move to the outskirts of the capital where land prices are less expensive and concepts much more fluid.

For completed, central condominium rental rates, prices remain relatively high at a maximum of $4,000 per month. This is why it would be wise to disperse and move to the outskirts of the capital where land prices are less expensive and concepts much more fluid.

Download the full H12016 Knight Frank Market Highlights Report

Comments