(Being in your 20s and even your 30s affords you so much time and opportunity to earn that you might not have later on in life. It’s also the best time to start saving money for your first home investment. Image Supplied)

If you’re under the age of 30, working a decent job, and don’t have a home to call your own, then it’s the perfect time to save for your first house. Cambodia’s property selection, especially in Phnom Penh, are plentiful, and in a few years’ time, you’ll practically be swimming in borey/condominium choices!

At the back of your head, you might be saying “But I’m young! I want to see the world and experience new things!” or “Have you seen the prices? They’re so expensive!”. While both are popular concerns, they’re also not as serious as you might initially believe.

Why you should start saving for a home while in your 20s

Being in your 20s is probably one of the best times to start saving. Unfortunately, youth is often wasted on the young. Most young working adults spend their money on travelling and expensive food/services - thinking they’ve worked for this, why shouldn’t they spend it?

And that’s where the problem lies. Being in your 20s affords you so much time and opportunity to earn that you will not have (to the same degree) in your 30s and 40s. Setting some money aside, especially in your early 20s, will give you a big advantage once you eventually realise the value of owning a home. As the saying goes, “The early bird gets the worm”.

The money you should set aside on a regular basis doesn’t have to be big either! By cutting down on things you spend every day or every-now-and-then, you’ll eventually accrue enough savings to consider getting a downpayment.

We’re not saying you should completely stop spending on the fun things in life (though if applicable, do it!), but you can definitely compromise on their frequency for the sake of your future home security.

Tips to save money every day, every week, every month

Limit the international travel

(Carefully selecting and limiting your international travel is a great way to save money. Photo by Economytraveller.com)

You’re young and the world is your oyster. But much like the pearl in it, it can get really expensive. If you have a knack for travelling abroad multiple times a year, you might wanna cut that down to once or twice per year, at most.

International ticket fares cost no less than $200 USD (return flight included). Of course, airfare tickets aren’t the only thing you’ll be spending on. Depending on how long you’re staying and what you’re gonna be doing, you could budget anywhere from $300 USD to $1,000 USD for accommodation, food, souvenirs, and activities.

You’ll be saving around $500 USD per year at least simply by holding off on that trip. We know cutting down on this expense can be a pain for the travel bug in you. But these are substantial amounts you could be saving for a real estate property you can call your own!

Limit the expensive restaurants

(Good burgers like this can cost upwards of $10 USD per serving in Phnom Penh. Photo by Timothy O’Toole)

Cambodia, especially Phnom Penh, is home to a lot of good food! The capital city hosts a multitude of cultures offering their cuisines alongside local Khmer favourites. But as the market for good food grows, so do their accompanying price tags.

The best meals are often among the expensive - easily ranging from $20 USD to $100 USD per meal. If you like to spend above $10 USD or more per meal, that means you’re spending around $20-30 USD per day on food. That amounts to around $600-900 USD on food every month, which is a lot!

You can scale back on expenses by opting for cheaper (and often better value) food options, or plan your grocery shopping and cook from home more often. Since Phnom Penh is filled with superb food options, good eats can cost as little as $3-5 USD per meal.

|

Food expense breakdown |

|||

|

Cost per meal (USD) |

Frequency per day |

Total cost per day (USD) |

Total cost per month (USD) |

|

10 |

3 |

30 |

900 |

|

5 |

3 |

15 |

450 |

You could save around $450 USD (or more) per month or $5,400 USD per year simply by opting to eat meals at more modest places. Let’s not forget that you can save more money if you know how to cook! And if you don’t know how to cook, it’s a damn good life skill to have, so you better learn.

Learn to say “No” to expensive activities/outings

(Saying “No” can be good for your wallet and your eventual downpayment for your very own home. Photo by LostPlate.com)

We love our friends and family. But constantly saying “Yes” to whatever and wherever they want to do or go can hurt your savings! It’s quite difficult to put a value on activities as these vary wildly. But for the sake of discussion, let’s assume some financial implications:

Let’s say you’re spending $40 USD on outings every weekend - and that’s on top of your food expenses such as drinks, movies, transportation, or whatever is trending. If you go out every weekend (4x month) that could be an additional $160 USD of monthly expenses.

|

Activity/Outing cost per month |

||

|

Total activity cost per weekend (USD) |

Frequency per month |

Total cost per month (USD) |

|

40 |

4 |

160 |

|

40 |

2 |

80 |

Again, activity/outing costs vary wildly. But one thing is for sure: going out every weekend is a bad idea if you’re planning to save money for a future project like owning your very own home.

Skip the expensive coffee

(Cutting down on your daily coffee can add up to significant savings at the end of the year. Photo by Discover Cambodia)

At the risk of being chased out of Phnom Penh with pitchforks and lit torches, we have to say frequent consumption of expensive coffee can be bad for your savings! Let’s crunch some numbers.

|

Cost breakdown of buying coffee per month |

||||

|

Cost per branded coffee (USD) |

Frequency per day |

Total cost per day (USD) |

Frequency of days buying coffee |

Total cost per month (USD) |

|

2.5 |

2 |

5 |

30 |

150 |

|

2.5 |

1 |

2.5 |

20 |

50 |

You could be spending up to $150 USD per month if you’re spending $2.50 USD per serving of coffee and buying twice a day. Cutting this down to effectively half (in terms of frequency) can save you an additional $100 USD per month or $1,200 USD per year!

We understand that this is going to be a tall order for a country that loves its caffeine. But constantly consuming coffee - multiple times a day - can slow down the progress of your savings.

If you are looking to treat yourself to one excellent coffee, try out these cafes in Phnom Penh.

Track your daily/weekly/monthly expenses

![]()

(Tracking your regular expenses can you better insight into your spending habits - and know where to save. Photo by Review Geek)

Listing down what you spend isn’t a bad thing, it's a smart thing to do to keep you in track! It will provide you with insights into your spending habits. Here are a few questions you can answer by tracking your regular expenses:

- What am I spending on?

- How much am I spending on it?

- How often do I spend on it?

Answering the questions above will give you a picture of your spending habits and eventually help you decide on how best to maximise your savings with these questions:

- How come I’m not able to save any money?

- Do I really need to spend on this?

- Can I limit how much I’m spending on this?

Knowing your spending habits goes beyond being able to save money, it can actually give you a picture of what your priorities are! Hence, why big companies today are invested in acquiring the financial data of consumers. But that’s a discussion for another day.

Curious about home loan options in Cambodia?.

Create a separate bank account specifically for savings

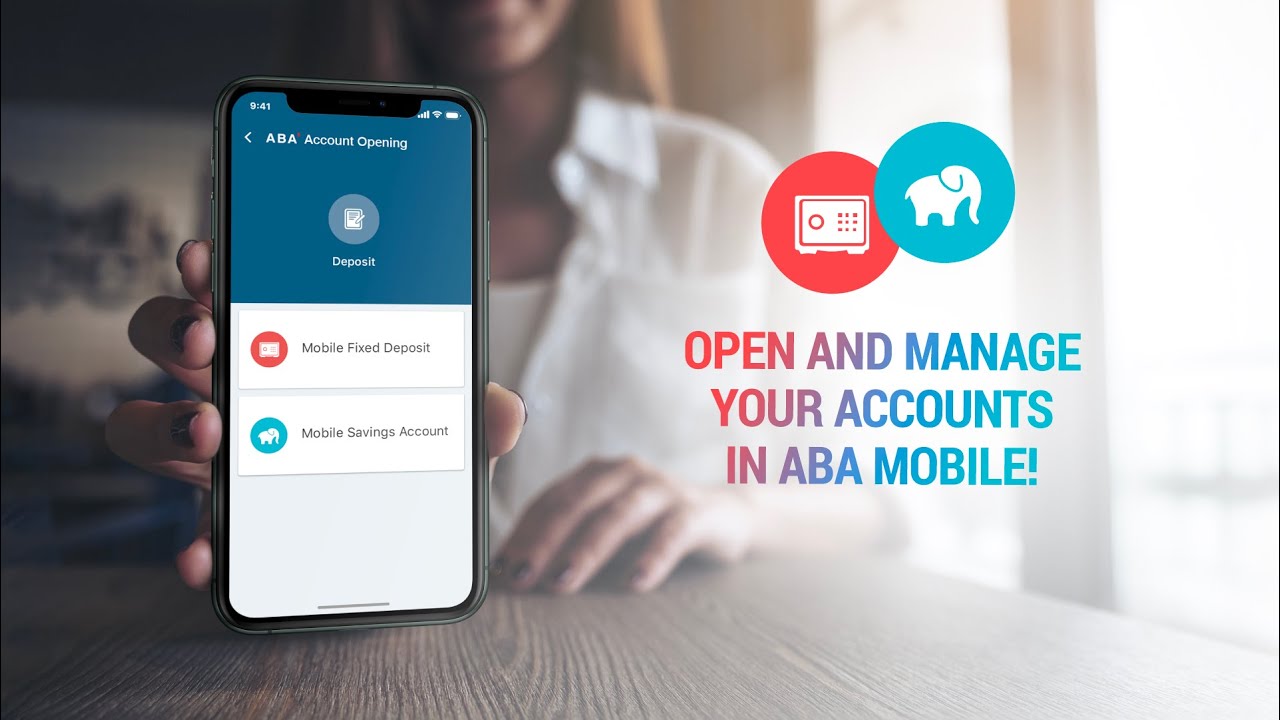

(Banks like ABA offer convenient ways to create a savings account. Something you’ll need for any savings goal you may have. Photo by ABA)

As my mom always says, “Save first and spend what’s left”. Banks like ABA allow you to make a separate bank account easily through your mobile device. Whenever you receive your salary or have money coming your way, we suggest saving a portion first before spending any of it, not the other way around!

How much you need to save is entirely up to you as you know your needs best. A piece of good advice on knowing much to set aside is to “save money until it hurts”. This means you should set aside money right away and leave enough to meet your regular necessities. For the sake of putting a figure on it, this could range anywhere from saving 25% to 30% of whatever funds come your way.

And remember, do not touch your savings unless it’s absolutely necessary!

Read more in our ultimate guide to banking for foreigners in Cambodia.

“Save money, it will be worth it”

You may have already heard this several times from your elders, and it’s a cliché, we know. But you’ll soon realise that it’s cliché because it’s true.

Cutting down on daily comforts will be difficult at first, and the temptation to indulge yourself will be alluring for sure, but trust us when we say it will pay off in the end. Owning a home is the best form of security you can give yourself, and quite frankly, you owe it to yourself to secure your future.

So, the next time you’re thinking of buying your 3rd coffee at 5pm in the afternoon, ask yourself, “Do I really need this?”.

Stay up-to-date on the real estate industry in Cambodia and get real-time updates on real estate news as they happen. Download the Realestate.com.kh App now!

Article by:

Comments